2021 Flooring Industry Stats and 2022 Prospect Outlook

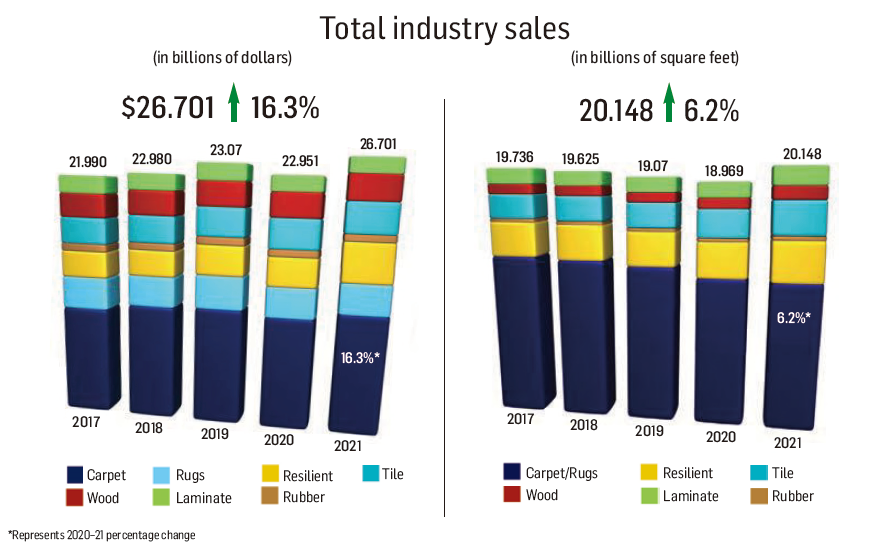

Supply chain disruptions. Raw material scarcity. Inflation. One would think those issues would negatively impact any industry. But there was enough momentum on the part of consumers to drive the U.S. flooring industry to post record gains as shoppers continued to spend on home improvements in lieu of lavish vacations.

With that, the U.S. flooring industry went on a wild ride dating back to third quarter 2020, which carried through to the end of 2021. Residential carried the day, which had its best year in modern memory; resilient, particularly the waterproof category of SPC/rigid core, posted ridiculous gains. SPC, the hottest category to possibly ever enter the industry, is an imported product—or at least 95% of it is imported.

1. Resilient-SPC segment continues to lead LVT's charge

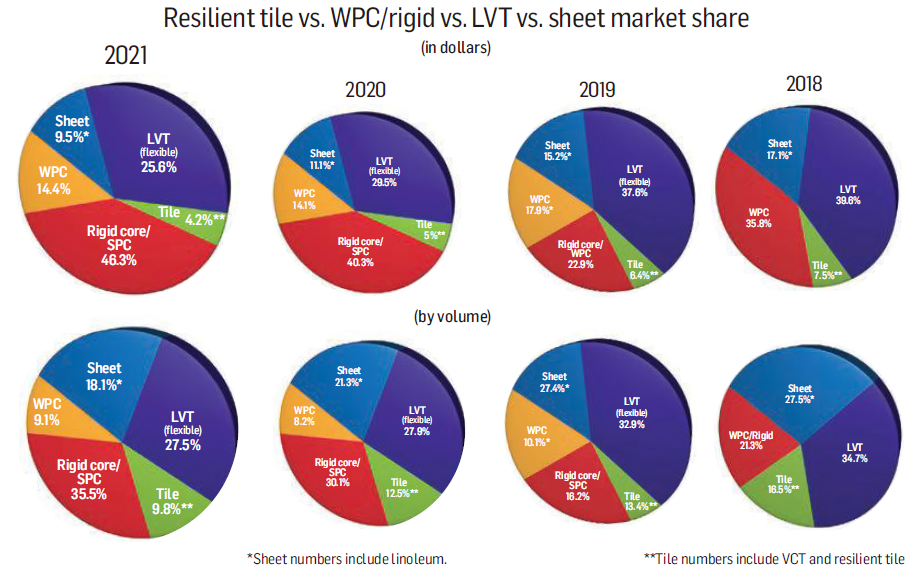

Resilient category contin-ued its wild ride in 2021 with another year of major growth—the resilient category is propped up by one main LVT subsegment: rigid core.

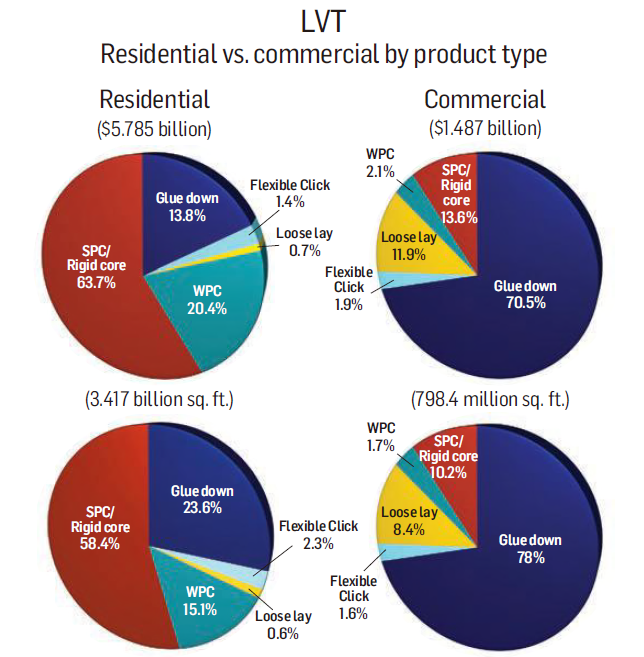

While flexible LVT products and the newer WPC still command decent shares of the market, it was rigid core/SPC that again took the lead in 2021. In terms of its command of the LVT segment in which it resides, 2021 saw an increase from 59.2% to 63.7%. In terms of dollars, it generated $3.699 billion of the LVT market's $5.807 billion in 2021.

-

In addition to traditional SPC, there is a new breed of waterproof rigid core flooring beginning to make waves. Hybrid constructions now tout “real wood” veneers on top of waterproof SPC constructions, marketed as giving the consumer the best of both worlds.

-

SPC's sister-subsegment, WPC, saw a respectable gain in dollar sales in 2021. Much of that came from Floor & Decor. FCNews pegs the category at slightly under $1.2 billion and 520 million square feet.

-

Glue-down LVT experienced a 15.5% increase in dollars in 2021 and 8.3% growth in volume (residential and commercial combined), which can be explained somewhat by price increases. The subsegment's market share also dropped from 16.7% to 13.8% of 2021's much larger residential LVT pie. Flexible click LVT, on the other hand, experienced a 21.6% drop in dollar sales in 2021 vs. 2020 and is becoming obsolete due to the more popular rigid products.

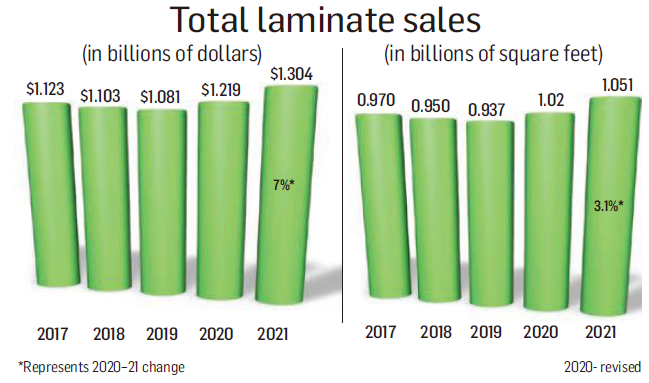

2. Laminate-Segment picks up right where it left off in 2020

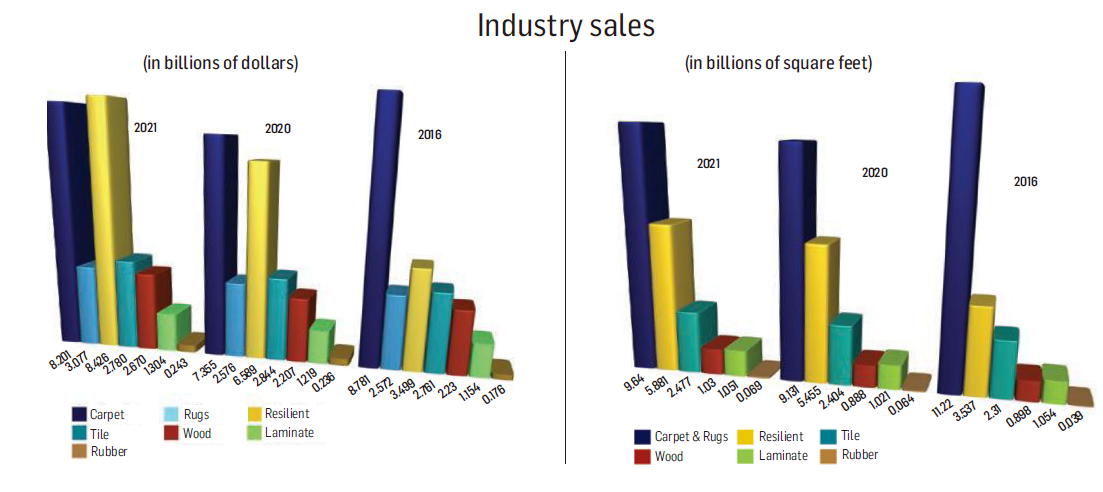

The resurgent laminate flooring category continued on its upward trajectory in 2021 as sales reached $1.304 billion, FCNews research shows. That represents a 7% increase over 2020's numbers, which have been revised upward since the publication of last year's Statistical Issue. That $1.304 billion also represents the highest level of sales seen since 2006.

The resurgence that laminate flooring is currently enjoying in the U.S. market is expected to continue for the forseeable future—certainly as long as supply chain issues surrounding competing hard surface categories persist.

3. Commercial-Uptick in end-use activity lifts segment sales

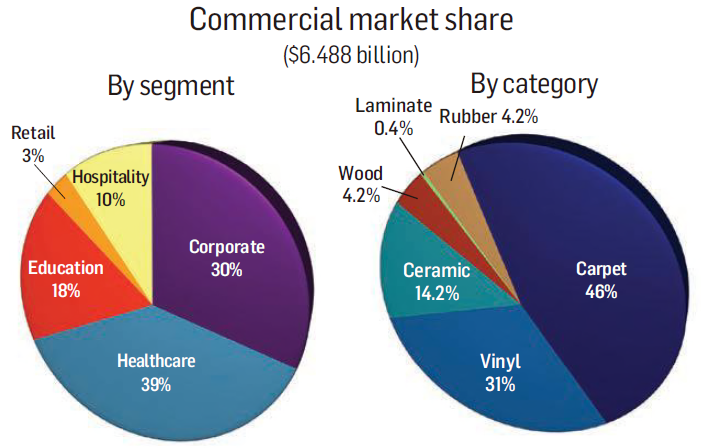

Preliminary FCNews research shows the commercial market totaled $6.488 billion in sales in 2021, an uptick of 6% over 2020. While modest, this marks an about-face for the sector, which fell just over 11% in 2020.

The coronavirus pandemic impacted all sectors of the economy last year as businesses saw supply chains interrupted, demand for products and services decline, and government-mandated closures. Some major commercial flooring sectors, such as education, retail and healthcare, recovered faster than others, according to published reports. Hospitality is showing signs of coming back as budget and travel restrictions are being lifted while office spaces are gradually filling up as more employees return to work.

The outlook for the rest of 2022 is even more positive, particularly for nonresidential, with significant and more balanced growth expected across this sector. If current trends continue, this positive outlook looks to accelerate in 2023. According to the AIA Construction Consensus Forecast Panel of leading economic forecasters, nonresidential building construction spending is expected to expand 5.4% in 2022 and strengthen to a 6.1% expansion in 2023.

Excerpt from--FCNews

-

-

WhatsApp

-

-

-

Wechat

-